Introduction to NodeDAO

Get started with NodeDAO

Easy staking with NodeDAO. Experience the convenience of staking on Ethereum 2.0 with NodeDAO's liquidity staking service. Our platform combines first-class, experienced validators to provide secure infrastructure while actively looking for DeFi strategies for nETH/rnETH tokens for users to provide the best staking returns for our users. With NodeDAO, you can cancel the staked ETH at any time when the redemption pool has sufficient funds, and when the funds are insufficient, you can initiate an asynchronous withdrawal at any time, and you can claim the unstaked ETH for up to 7 days.

NodeDAO's founding organizations are: ChainUp Cloud, XHash, HashKing. They formed the original decentralized autonomous organization (DAO) governance.

Join the NodeDAO revolution and easily achieve your staking goals. This document will guide you through the process.

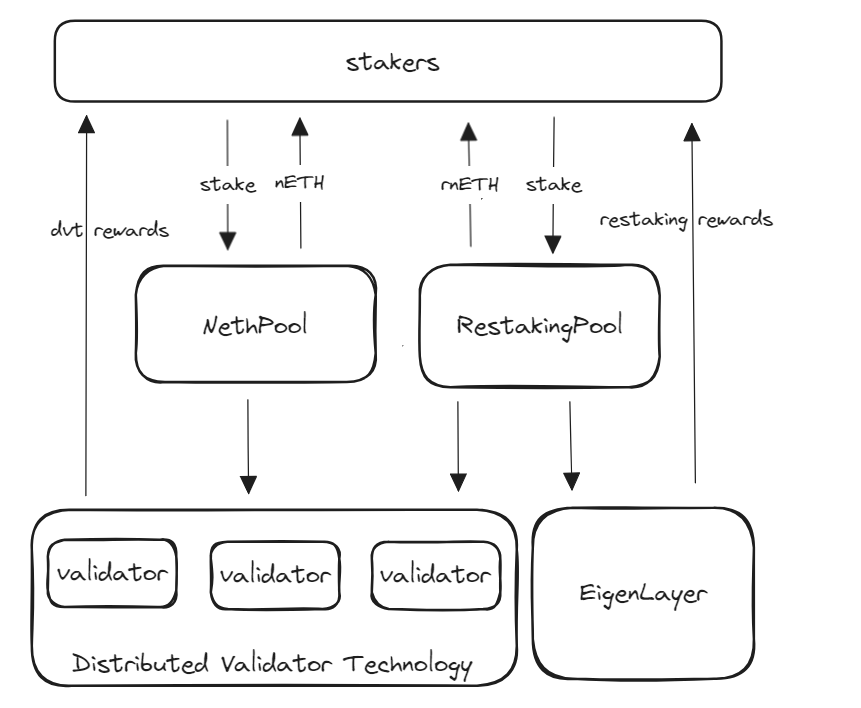

NodeDAO Protocol

NodeDAO Protocol represents a cutting-edge solution for Ethereum liquidity, combining traditional liquidity staking and re-staking concepts with a decentralized validator network. Features include:

Proportional profit-sharing model that enables multiple validator service providers to join and offer their services.

Staking ETH will mint nETH/rNETH, increasing income through DeFi services.

Anyone can apply to join the node operation network, enhancing the level of decentralization.

Products

NodeDAO Staking Pool

NodeDAO Staking Pool is a staking option where your ETH is combined with the staked assets of other participants. Every deposit in the pool is converted into nETH, NodeDAO's ERC-20 standard tokenized ETH. Token holders have the right to withdraw the staked ETH, while staking rewards will be issued to token holders in the continuous appreciation of nETH. NodeDAO tokens play a vital role in the pool by making your stake liquid and providing the opportunity to earn additional income through DeFi protocols.

NodeDAO Restaking Pool

The NodeDAO Restaking Pool is another staking option where your ETH is combined with the staked assets of other participants. Every deposit in the pool is converted into rnETH, NodeDAO's ERC-20 standard tokenized ETH. Token holders have the right to withdraw the staked ETH, and staking rewards will be issued to token holders in the form of continuous appreciation of rnETH, while also receiving Eigenlayer points rewards. NodeDAO tokens play a vital role in the pool by making your stake liquid and providing the opportunity to earn additional income through DeFi protocols.

System Flowchart

质押奖励Staking Rewards

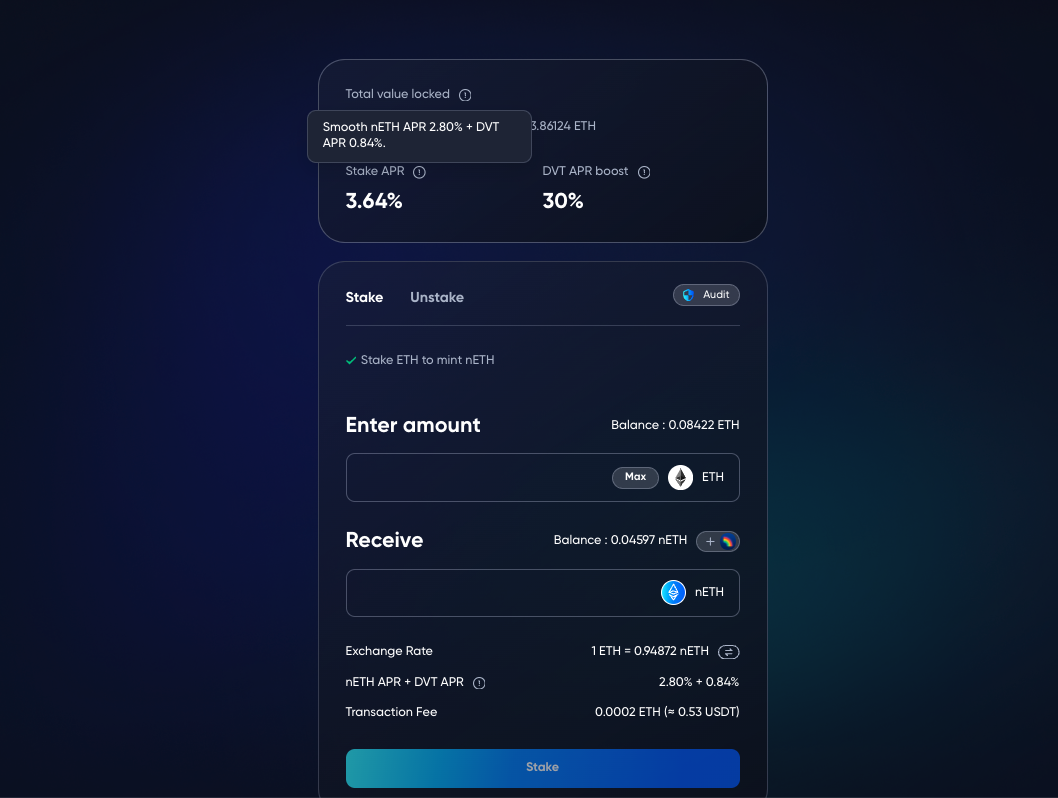

After the user successfully stakes, he will receive nETH or rnETH corresponding to the staked amount. The nETH or rnETH reflects the APR through the increase in the exchange rate with ETH.

How to view APR? On the staking page, Stake APR includes the native APR and the APR from SSV increase. The native APR is adjusted regularly with changes in execution layer/consensus layer rewards, and the SSV increase APR changes with SSV network incentives.

Contact Us

NodeDAO Twitter: @Node_DAO

Last updated